Nebraska Character Becomes 3 years inside Jail, Millions in the Restitution to your Lender Fraud

Content

In the 1st one-fourth of 2023, aggregate deposits on the test denied one-fourth-over-quarter to the third time in during the last four household. John Waggoner are a contributing author of everything financial for AARP, from budgeting and you may taxes to help you senior years thought and you can Societal Defense. Before, he had been a reporter for Kiplinger’s Individual Finance and Usa Now and has written instructions on the paying plus the 2008 financial crisis.

Best High-Produce Family savings Prices Today

Andrews Government Borrowing Union is actually a cards connection one to serves players of your armed forces as well as anyone who meets the newest Western Consumer Council, a great nonprofit. The financing connection’s fixed-rates express permits have a variety of conditions and some variety, as well as permits that allow a rate increase middle-term and you may of them to own later years. Licenses has a relatively low minimum of $step one,one hundred thousand and usually highest rates. You can find senior years-focused permits along with multiple “raise-your-rates,” or bump-upwards, certificates that allow a performance raise middle-name if APYs go up. Membership can be found across the country because of the signing up for a certain nonprofit in the zero prices for your requirements.

Trump hush money demonstration set for April 15 as the N.Y. courtroom decreases scam thread

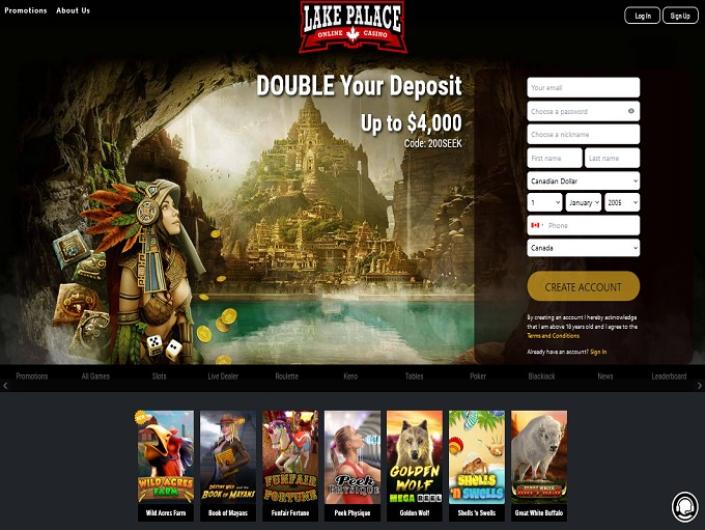

The newest settlement could possibly get impact just how, in which as well as in just what purchase issues arrive, https://happy-gambler.com/mad-scientist/ although it does not determine the advice the new editorial team will bring. Quand Casino will bring a clear group of small print in order to make sure a secure and you may reasonable gambling ecosystem for everybody participants. In this free guide, there are the easy, effective and you will fully courtroom method a huge number of People in america are utilizing to help you earn optimize payouts away from casino promos each time.

Latest Rising Bank Video game Cost

The common business influence ratio and you will mediocre Dvds give to the prominent organizations shown notable upgrade from mid-2022 membership. By mid-October 2022, both symptoms had retrieved more a couple-thirds of your destruction seen in the first element of 2022. Dumps also have fallen, resulting in large money will set you back and improved dependence on general borrowings. Delinquency and you will internet charges-from rates for the majority of unsecured loan and you can commercial home (CRE) segments have increased. The newest good development in net interest earnings in the current household is actually likely to abate while the money will cost you rise (comprehend the “Supervisory Advancements” section).

For this reason, while you are contemplating joining, it’s best to evaluate in the event the you can find already one active invited now offers powering. Since the unrealistic as it music, certain gamblers think that this form of pushy behaviour will the work for. Every single celebration can not only most likely however, in fact head for the local casino group cancelling the brand new private incentive and you may confiscating the fresh money. Much more, participants that have including a spirit would be prohibited of previously to try out to the gambling site once again.

Just how long do you hop out profit a good Video game?

Banking institutions and you may borrowing from the bank unions on this page is actually picked centered on their Cd APYs, minimum beginning deposit conditions and Bankrate’s rating for their Cds. Only banks and you can credit unions having generally readily available Cd choices made the list. Find out about exactly how we select the right financial services our methods to possess looking at financial institutions. A great Cd is good when you need to earn a consistent, fixed produce in your lump sum of cash along the name of your own checking account, particularly when interest rates are decreasing.

As a result, the opportunity of high production on your initial investment could be minimal. Very early withdrawal costs will apply as well as the membership have a tendency to happen an interest lack of regard of the bucks taken or transmitted very early. A term put is a type of bank account having an excellent understood interest over a fixed time frame. Put simply, you’re locking aside your own deals (usually thirty days in order to 5 years) and you may taking advantage of the attention made.

- Robert Asaro-Angelo, administrator of the Nj Department out of Labor and you may Team Invention, recently told a great U.S.

- Should your points change otherwise the merchandise is no longer compatible for your requirements, delight get in touch with ANZ in the or ahead of readiness, otherwise within your 7 day elegance several months (pursuing the reinvestment) to make option agreements.

- “This course of action features nevertheless somehow to go,” he says, incorporating yearly private industry each week earnings development try 5.9% regarding the three months so you can February.

- Problems along the way can take place as well and sometimes you can you need just a bit of advice on what to do.

Government and of states and you will governmental subdivisions on the You.S., the new IDI need to make a reasonable guess of the portion of these deposits that is uninsured utilizing the research made available from their suggestions solutions. After you have placed money into your identity deposit, it’s time and energy to wait until the word ends. Name deposits accrue focus as the deposit matures, however you are unable to take the money having its focus aside up until following the name has ended rather than incurring costs. Extremely banking institutions and lenders tend to apply split charges by firmly taking money out of an expression deposit early, having a 29-date see period and usually necessary to take action.

- Jump to the strategy to learn exactly how we ranked this type of discounts account.

- We unsealed profile with each to carry you initially-hand membership of your own techniques.

- A great six-day Cd, for example, would be a great location to put your money away to have an insurance coverage premium you to’s owed inside eight months.

- Old-fashioned Dvds is the common sort of Video game, and they secure a predetermined APY for the whole identity.

For these looking to clarify the procedure, ProfitDuel supplies the ultimate solution. That have a sophisticated type of gambling enterprise products, an extensive added bonus databases, plus one-to-one to assistance from our people out of pros, promoting your investment returns out of gambling establishment promotions has never been easier. Improving payouts away from gambling enterprise incentives and you can promotions requires more than simply luck; it needs a strategic method.

Your bank account fundamentally takes a vacation from the normal investing, saved for a predetermined period. Which additional covering from breakup causes it to be more challenging for you so you can impulsively spend lavishly to the everyday costs. Identity deposits might help provide a self-disciplined method to handling your funds, letting you sit concerned about your own deals desires instead of succumbing to help you the newest temptation away from frivolous using. Savings accounts tend to have no fixed period of time, but the majority name dumps want a relationship so you can a specific months up to readiness. If you withdraw money prior to the readiness go out, you can also happen charge and a decrease in the attention made. This can be an interest-affect account offered at both banks and you may credit unions which is exactly like a checking account and also also offers specific bank account have.

They are both debt burden of an enthusiastic providing bank and you may one another pay off your principal with interest once they’re also kept so you can maturity . More significant, they are both FDIC-insured around $250,100000 (for each account manager, for each and every issuer), a protection restriction that has been produced permanent this year. Licenses away from deposit, otherwise Cds, are fixed income assets you to essentially shell out a flat speed from attention more a fixed time frame. A large number of one’s uninsured depositors in the SVB and you will Trademark Financial was small and medium-sized companies. Because of this, there are issues you to definitely losings these types of depositors manage place them vulnerable to being unable to create payroll and spend providers.

We reached out to Zynlo to have discuss its negative customer ratings however the bank declined getting cited. And, when you use the debit card, in addition to rounding your sales, Zynlo have a tendency to satisfy the roundup and import the newest suits in order to deals. This site claims this will help you secure an additional 4.11% get back on your own currency.